The continuous slide in Manpasand’s stock is headline of the corporate news world today. With news of auditing major Deloitte Haskins & Sells resigned as statutory auditors of Manpasand Beverages made the situation worse.

Manpasand Beverages: A short introduction of company’s business

Manpasand Beverages is engaged in the business of manufacturing of fruit juices in the beverages segment. The company is engaged in the business of manufacturing of fruit drink products with a primary focus on mango fruit. The company offers mango-based fruit drink under the Mango Sip brand. It also offers its products in other brands, including Fruits Up, Manpasand Oral Rehydrating Salts, Pure Sip and Coco Sip.

Manpasand Beverages: Down Trend in Share Price

The stock has downtrend for sixth consecutive sessions and stock has cracked 42.25% since 22 May. The stock of company opened at Rs 248.30 with 9.99% down on BSE on Wednesday. The constant fall in the Manpasand Beverages stock has worst hit the value of top mutual funds who had invested in this company.

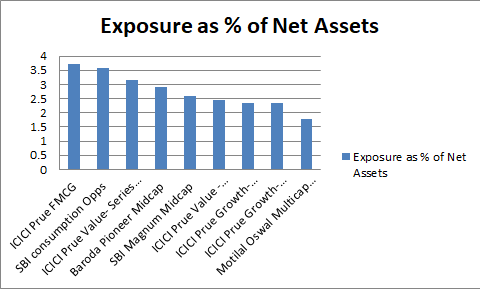

Let’s have a look on following chart.

The chart is indicative. There are many funds which bear exposure in Net Assets. ICICI Prue FMCG has the highest exposure as 3.73% of net assets (portfolio invested in Manpasand Beverages) and SBI Equity Savings has exposure as 0.33% in net assets. The investor must note that Manpasand Beverages stock has fallen 38% in the past one month and 42% in the past three days.

The news of this downfall of stock is a panic for mutual fund investors as seven mutual funds held 1.283 crore shares of Manpasand Beverages to the tune of Rs 535.23 crore at the end of April 2018.

Followings fund houses hold stakes in Manpasand beverages. The holding of share worth showed in table is in crore in April 2018.

| Name of Fund House | Share holding Rs. ( in Crore) |

| Motilal Oswal Mutual Fund

|

256.61 |

| SBI Mutual Fund

|

202.92 |

| ICICI Prudential Mutual Fund

|

47.82 |

| BNP Paribas Mutual Fund

|

23.63 |

| Kotak Mahindra Mutual fund

|

2.04 |

| Baroda Pioneer Mid-cap Fund – Growth

|

1.20 |

| BOI AXA Mutual fund

|

1.01 |

Source: AceEquiety

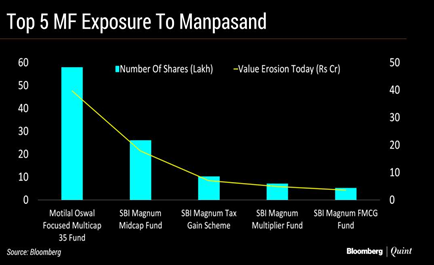

Motilal Oswal held shares worth Rs 256.61 crore in Manpasand Beverages in April 2018 and this fund house was the biggest loser among the mutual funds after crash in share price of Manpasand Beverages. Motilal Oswal Most Focused Multicap 35 Fund owns 58 lakh shares of the manpasand comprising about 1.8% of the scheme’s portfolio.

SBI Mutual Funds which is the second loser has Rs 202.92 crore shares worth holding in the stock.

Look at the below chart to understand the reality of the top five mutual fund exposure to Manpasand Beverages.

What should investor do?

Every investor who invested in the stock or related mutual fund has question: What should I do?

The investor who is planning to invest in this stock has also the same question in mind.

Before answering the question, we should read opinion of some rating securities.

“We believe the stock could face uncertain times in the near term in wake of this development and hence, we have decided to suspend our coverage on the stock until further clarity from the management,” – Religare securities

“We will wait for the Q4 FY18 results and further disclosures. We, thus, put our rating ‘Under Review’,” – Motilal Oswal

The brokerage has suspended the company’s rating for now. It had earlier a ‘Buy’ on the stock. While the Manpasand Beverages said, “Everything related to financial results announcement and the timing of this event is purely coincidental and has no direct correlation. The board meeting has been postponed and the new date will be announced shortly. This is just a minor hiccup and doesn’t represent any long-term business impact.”

The company also said, “Manpasand Beverages has always focused on maintaining a sustained business growth. We still have a long way to go to achieve our high ambitions and we are well on the way. We hope for the continued support of our shareholders and stakeholders in this process.”

After analyzing above statements, the investor should wait to make new/further investment in shares of Manpasand Beverages. The investor who has already invested in this stock should keep policy of WAIT AND WATCH.