Investing in mutual fund is great thing but its necessary that one can evaluate the best fund from the baskets of fund available. Performance of mutual fund scheme is derived based on some below mentioned ratios.

Sortino Ratio

The Sortino ratio measures the risk-adjusted return of an investment asset, portfolio, or strategy. A large Sortino ratio indicates there is a low probability of a large loss. When you compare mutual fund schemes, higher the sortino ratio, better it is for that scheme.

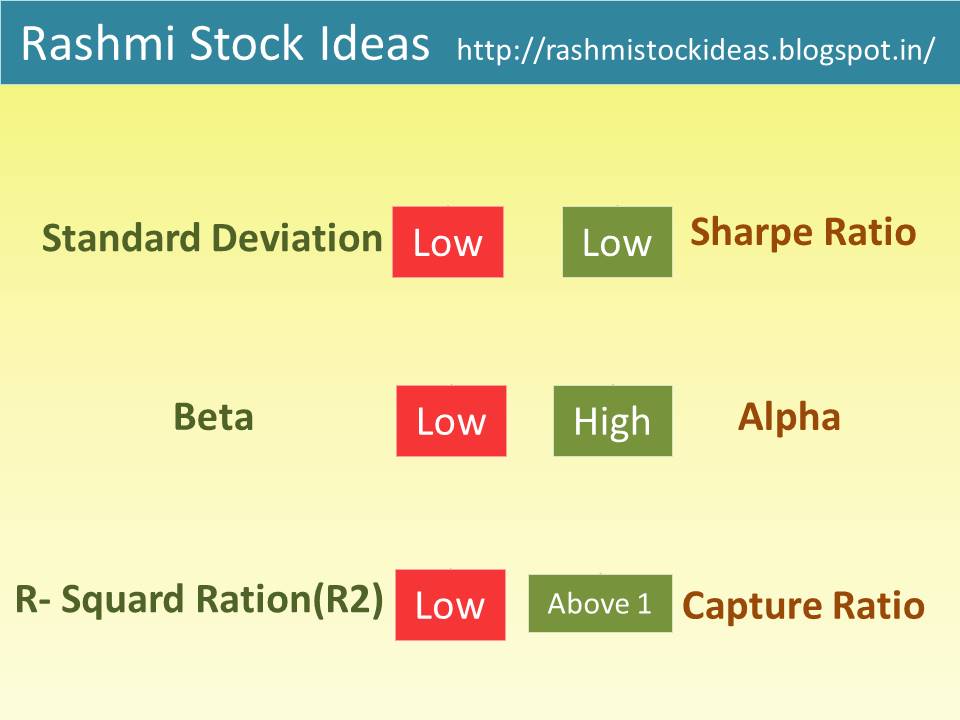

Alpha

Alpha helps to measure investment performance on adjusted risk basis. In Alpha it takes volatility of a fund portfolio and compare it with risk adjusted performance to benchmark index. A percentage measuring how the scheme performed compared to the benchmark index. Higher The Alpha better it is for scheme.

Beta

A beta of less than 1 means that the scheme is less volatile than the market.

A beta of greater than 1 indicates that the scheme is more volatile than the market.

Standard Deviation

Standard deviation measures the volatility the fund’s returns in relation to its average.

A fund has a 10% average rate of return and a standard deviation of 4%, its return will range from 6-14%.

Share Ratio

Share Ration of mutual fund scheme is calculated by return of portfolio minus risk free return, then dividing the result by standard deviation of portfolio returns. Higher the sharpe ratio is the better the fund’s return compare to risk adjusted

R-Square Ratio

R-Sqaure ratio matches performance with benchmark. R-squared is a statstical measure of percentage of asset or fund’s performance with benchmark. R-squared ratio is number betweek 0 to 100.